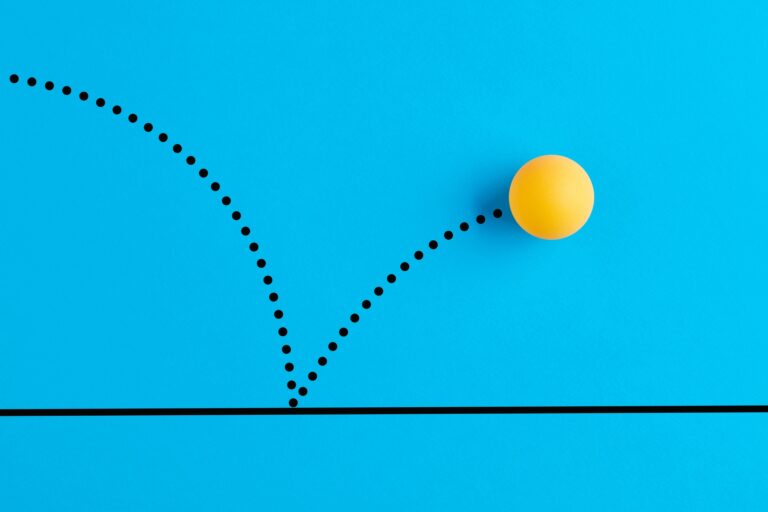

The Big Rebound

U.S. equity markets staged a strong recovery in the second quarter of 2025. After declining 18.9% from the February high, the S&P 500 rallied 24.5% from its April low to end the quarter up 10.94%, pushing year-to-date returns into positive territory at 6.2%. Small cap stocks, as represented by the Russell 2000, followed a similar path, declining 27.4% from a November 2024 peak before rebounding 23.5%. Despite this recovery, the index remained modestly negative for the year, down 1.79%.

The volatility that marked the first half of the year was largely driven by economic policy uncertainty, specifically the evolving stance on trade and tariffs under the Trump administration. As we discussed in our Spring 2025 letter, the administration’s proposal to implement broad-based tariffs introduced substantial uncertainty into financial markets. The initial tariff schedule included proposals ranging from 10% to over 100%, with both rates and targets fluctuating significantly from week to week.

While the intention behind these tariffs was to support domestic industry and reduce the trade deficit, the unpredictable nature of the proposals introduced considerable risk. Markets reacted swiftly and negatively as rhetoric around trade became more adversarial. However, in recent weeks, the tone has moderated. The administration has delayed implementation of several key measures and scaled back the most aggressive tariff proposals. At the time of this writing, the average effective U.S. tariff rate is estimated at 17%, up from roughly 2.5% in 2024.

Though still a meaningful increase, this level of adjustment appears less disruptive than initially feared. Broadly speaking, economists expect higher tariffs to exert pressure on economic growth, inflation, and interest rates. And yet, the actual impact has so far been muted. According to JPMorgan, global GDP grew at a 2.4% annual rate in the first half of the year, in line with long-term averages.

Macroeconomic Implications: Mixed Signals

Domestically, the data presents a mixed but generally stable picture. While macroeconomic indicators remain constructive, it is important to recognize that the effects of tariffs often arrive with a lag. In some cases, fears of higher future costs have prompted businesses and consumers to accelerate purchases, temporarily boosting economic activity. Over time, however, we expect the longer-term effects, including higher input costs, inflationary pressures, and margin compression, to become more visible.

At the company level, second quarter earnings reports have begun to reflect this evolving reality. U.S.-focused businesses in sectors such as financial services, healthcare, and technology have reported generally solid results. Meanwhile, firms with greater reliance on imported goods or global supply chains are beginning to feel the strain. General Motors, for example, attributed $1.1 billion in increased second quarter costs to new tariffs on autos and parts.

These results underscore a key point: Tariffs will likely affect companies unevenly. The ability to adapt, whether through supply chain diversification, cost reduction, or pricing power, will be critical. Many firms have already begun shifting operations to countries not impacted by the highest tariff bands. While this offers some insulation, strategic reconfiguration of global supply chains is neither fast nor easy.

Markets Respond with Optimism, For Now

Despite the policy noise and economic crosscurrents, markets have responded positively, and equity valuations have climbed. The forward price-to-earnings (P/E) ratio for the S&P 500 now stands at 22.2x, well above the 10-year average of 18.4x. At the same time, earnings expectations have moderated. At the start of the year, analysts forecasted 15% earnings growth for 2025. Current consensus estimates are closer to 9.3%.

This divergence, rising prices alongside softening earnings projections, raises important questions about the sustainability of the recent rally. Should earnings growth disappoint, or macro risks intensify, valuations may come under pressure.

However, this type of environment can also create opportunity. As always, our goal is not to predict short-term market moves but to remain prepared and responsive. Earlier this year, the correction gave us the chance to initiate or add to positions in several high-quality businesses at more attractive valuations. If volatility returns, we are prepared to do so again.

Looking Ahead

We are encouraged by the resilience shown by many of our portfolio companies and are cautiously optimistic about the remainder of the year. However, we remain watchful as tariff policy, inflation dynamics, and global trade conditions will continue to play a role in shaping the market landscape.

As always, we thank you for your continued trust and welcome your questions or thoughts.

Sincerely,