Navigating H2 2025: The Case for a Fresh Look at Small Caps

As we approach the midpoint of 2025, investors are assessing how to reposition portfolios for the second half of the year. With market sentiment stabilizing after a volatile Q1 and Q2, questions naturally arise: Should small cap equities hold a larger role in a diversified portfolio? Is now the time to revisit strategic allocation to this asset class?

Small cap stocks, typically companies with market capitalizations between $200 million and $7 billion, have historically exhibited unique behaviors across market cycles. These equities often present potential opportunities for long-term investors willing to navigate short-term volatility. As economic indicators shift and valuation spreads widen between large and small caps, H2 2025 could mark a compelling moment to reassess allocation strategies.

Understanding the Role of Small Caps in Portfolio Allocation

At Ironwood Investment Management, LLC, we recognize that portfolio construction is as much about risk alignment as it is about opportunity. In the current environment, marked by dislocation in small cap valuations and pockets of underappreciated earnings power, raising small cap exposure within your equity sleeve may offer a more balanced risk-return profile moving forward.

Market Trends Influencing Small Cap Performance in 2025

Several macro and microeconomic factors are converging in ways that could influence small cap equities in H2 2025:

- Interest Rate Dynamics: With the Federal Reserve signaling potential policy shifts in late 2025, rate-sensitive sectors, often prominent in the small cap universe, may benefit from more accommodative policy stances².

- Valuation Dispersion: The valuation gap between large and small caps has widened, creating potential inefficiencies and mispriced assets in the lower end of the market cap spectrum³.

- M&A Activity: As noted in Ironwood’s Small Cap Core strategy materials, small caps frequently become attractive targets during consolidation waves, offering potential upside catalysts that are not typically found in larger companies⁴.

These trends highlight why disciplined bottom-up research and selective exposure to high-quality small cap companies remain essential.

Ironwood Investment Management, LLC’s Small Cap Core Approach

Ironwood Investment Management, LLC applies a time-tested, research-driven strategy to small cap investing. The firm’s Small Cap Core strategy focuses on identifying what it terms “High I-Q” companies, businesses with:

- Exceptional management teams

- Strong financial positions and competitive moats

- Sustainable, adaptable business models

The strategy is built on fundamental bottom-up analysis, ESG integration, and a diversified portfolio of 60–80 positions with flexible, style-agnostic allocations⁵.

Ironwood’s Small Cap Core emphasis on patience, discipline, and active management has defined its investment approach since inception. By focusing on companies under $5 billion in market cap and avoiding sector caps, the Ironwood Small Cap Core strategy constructs a portfolio that seeks to exploit valuation discrepancies and long-term market overreactions⁶.

Why Now? Timing a Small Cap Allocation Adjustment in H2 2025

Given the current backdrop, including slower economic growth projections, renewed attention on U.S. domestic companies, and a rebound in small cap M&A, investors might find it worthwhile to consider increasing their allocation to small caps.

However, any adjustment should be calibrated based on individual investment objectives, time horizon, and risk tolerance. Small caps are inherently more volatile than large caps and require a longer-term mindset to capture potential upside.

At Ironwood, our portfolio managers believe that volatility can be a feature, not a flaw, especially when viewed as an opportunity to acquire high-quality businesses at attractive valuations. Our strategy’s low turnover and high active share reflect our commitment to long-term value realization, not short-term speculation⁸.

Why Work with Ironwood Investment Management, LLC on Your Small Cap Allocation?

Strategic Partnership Rooted in Discipline

When it comes to small cap investing, experience and conviction matter. Ironwood Investment Management, LLC offers a deeply researched, high-conviction approach designed to help clients identify and pursue potential opportunities in this complex asset class.

Our team of five investment professionals, backed by decades of combined experience, applies a disciplined, repeatable process to identify companies that exhibit quality fundamentals, generally including strong governance, and adaptability to change⁹. This allows us to build portfolios that not only align with investor goals but also reflect our values as a firm.

Tailored Support for Advisors and Institutions

As an independent, employee-owned boutique firm, Ironwood partners closely with institutions, sovereign wealth funds, and high-net-worth investors to build strategies aligned with long-term objectives. Whether you’re an advisor reviewing client allocations or an institution seeking specialized exposure, our team offers both expertise and personalized service.

Ready to Rebalance Your Portfolio for H2 2025?

If you’re considering how small cap stocks might fit into your broader allocation strategy this year, we invite you to connect with Ironwood Investment Management, LLC. Our team can help evaluate your current exposure and determine how a thoughtful increase in small cap allocation could support your investment goals over the long term.

📩 Contact us to schedule a portfolio consultation or learn more about our Small Cap Core Strategy.

Additional Ways to Contact Us:

Phone: (617) 757-7600

Email: info@ironwoodfunds.com

Website: https://ironwoodinvestmentmanagement.com

Footnotes

- Federal Reserve Board. “FOMC Economic Projections: March 2025.” FederalReserve.gov, accessed June 2025.

- BofA Global Research. “Small Caps: Undervalued and Underowned.” Bank of America Securities, Q1 2025 Market Outlook.

- Ironwood Investment Management, LLC. Small Cap Core Strategy Presentation Q4 2024, p. 25–26.

- Ibid., p. 6.

- Ibid., p. 13.

- Ironwood Investment Management, LLC. Small Cap Core Strategy Presentation Q4 2024, p. 13.

- Ibid., p. 5.

Important Disclosures & Disclaimers

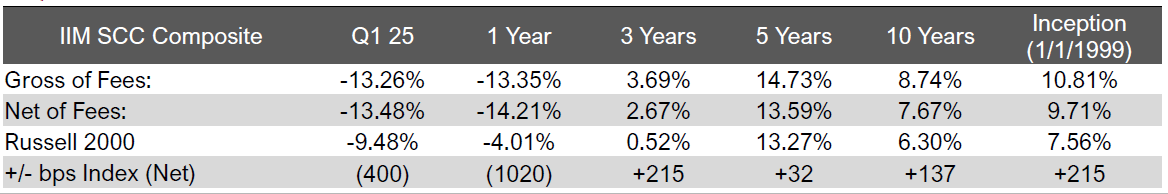

Performance Statistics – as of Q1 2025

Ironwood Investment Management®, LLC (Ironwood) is an independently managed investment advisory firm providing investment advisory services to institutional clients, mutual funds, and high-net-worth clients.

The firm is a registered investment adviser with the Securities and Exchange Commission. SEC Registration does not imply a certain level of skill or training.

Accounts in the Small Cap Core composite include separately managed, fully discretionary, fee-paying portfolios. Portfolios are invested in undervalued securities, the majority of which will have market capitalizations under $2.5 billion at cost, including securities with growth and/or value characteristics. Securities are considered undervalued when management believes the current share price does not accurately reflect the long-term economic value of the underlying company.

Ironwood Investment Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ironwood Investment Management, LLC has been independently verified for the periods January 1, 1999, through December 31, 2021. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

The Small Cap Core composite has had a performance examination for the periods July 1, 2002, to December 31, 2021. The verification and performance examination reports are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The creation date of the composite: July 2002. Performance inception date of the composite: January 1, 1999. Prior to July 2002, portfolios were included in the composite when at least 75% of the portfolio was invested in equity securities and when at least 75% of the portfolio was invested according to the investment style of the composite. Subsequent to July 2002, portfolios are included in the composite after the first full month of being fully invested.

Returns are presented gross and net of management fees and include the reinvestment of all income. Net returns are calculated based on the highest fee of 1.00%. Investment management fees are 1.00% on the first $25 million, 0.90% on the next $25 million, 0.80% on the next $50 million, and 0.75% over $100 million on an annual basis, and a client’s return will be reduced by these and other related expenses. The actual fee charged to an individual portfolio may vary by size and type of portfolio and may be negotiated. Actual investment advisory fees incurred by clients may vary.

The Russell 2000 Index consists of the 2000 smallest stocks in the Russell 3000 Index, representing approximately 8% of the U.S. equity market capitalization. The indices have been reconstituted annually since 1989. Ironwood returns and Index performance reflect reinvested interest income and dividends in U.S. dollars.

A list of composite descriptions and a list of limited distribution pooled fund descriptions are available upon request. Past performance is not indicative of future results. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. Prior to May 2006, the Firm was known as Ironwood Capital Management, LLC.

Past Performance is Not Indicative of Future Results

The performance data provided in this blog reflects past performance, which may not be representative of future results. Investing in small cap stocks and other securities involves substantial risk, including the potential loss of principal. There is no guarantee that any investment strategy will be successful.

Forward-Looking Statements

This blog contains forward-looking statements, including expectations or forecasts about the performance of the market and specific securities. These statements are based on Ironwood Investment Management, LLC’s current beliefs and expectations but are subject to change without notice. Actual results may differ materially from those expressed or implied due to various risks and uncertainties, including market conditions, economic factors, and changes in government policy.

No Offer or Solicitation

This blog is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities or investments. It is not intended to provide investment advice or to serve as a recommendation regarding any investment strategy. No client-adviser relationship is formed by reading this blog.

Conflicts of Interest

Ironwood Investment Management, LLC may hold positions in or recommend securities discussed in this blog. Clients should carefully review any investment strategy before committing to ensure it aligns with their investment objectives and risk tolerance.

Regulatory Disclosure

Ironwood Investment Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.