Introduction

Large caps and the Magnificent Seven have dominated the headlines in recent years, but good returns have been available elsewhere. Small-cap investing has continued to offer potential opportunities, even through challenging cycles.

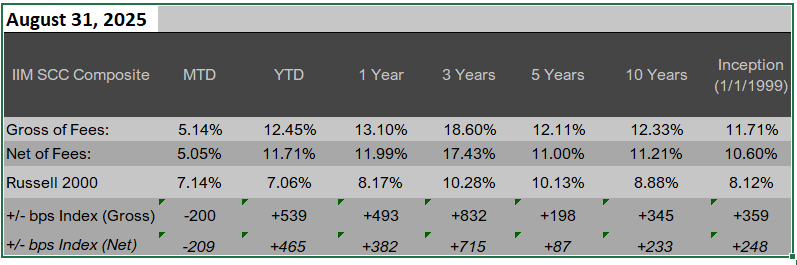

At Ironwood Investment Management, LLC, the Small Cap Core (SCC) Strategy reflects that resilience. Year to date in 2025, through August 31, 2025, the strategy is outperforming the S&P 500. Over the last 10 years, it has essentially kept pace, and over the past 26 years, it has significantly outperformed.

As of August 31, 2025, Ironwood’s SCC performance compared to the S&P 500** is as follows:

- Quarter to Date (2025): Ironwood SCC 10.71% (gross) vs. S&P 500 4.32%

- Year to Date (2025): Ironwood SCC 12.45% (gross) vs. S&P 500 10.79%

- Last 10 Years (since 08/31/2015): Ironwood SCC 12.33% (gross) vs. S&P 500 15.01%

These results highlight why small-cap investing in 2025 continues to matter. Despite periods of headline-driven underperformance, disciplined small-cap strategies have demonstrated their ability to deliver potential diversification and long-term value.

What Is Small-Cap Investing in 2025?

Small-cap investing in 2025 focuses on companies with market capitalizations between $120 million and $7 billion. These firms are typically more agile than large-cap peers and may operate in emerging or niche industries.

Why small caps stand out:

- They are less heavily followed by analysts, creating opportunities for research-driven managers.

- Their prices may experience more volatility, which can provide attractive entry points.

- They often represent the next generation of innovators.¹

For disciplined investors, these dynamics provide access to potential growth and diversification that large caps cannot replicate.

Why Small-Cap Investing Matters in 2025

Despite the headlines, small caps continue to matter. In fact, conditions today make the case stronger than ever.

1. Attractive valuations. Small caps are trading at some of their steepest discounts to large caps in more than 20 years. Historically, such valuation gaps have preceded stronger forward-looking returns.²

2. Market concentration at extremes. The Magnificent Seven account for more than one-third of the S&P 500. Small caps provide diversification away from this concentration, reducing reliance on a handful of companies for performance.

3. Economic shifts benefit smaller firms. Reshoring, infrastructure investment, and domestic supply chain realignment all favor nimble companies that derive most of their revenue from U.S. markets.

4. Long-term performance perspective. Year to date in 2025, through August 31, 2025, Ironwood’s Small Cap Core Strategy is outperforming the S&P 500. Over the past 10 years, it has kept pace. And over the past 26 years, it has significantly outperformed. This reinforces why small-cap allocations remain an important part of a long-term portfolio.

5. Innovation beyond the spotlight. From healthcare to clean energy, small caps continue to drive innovation that large caps cannot match.

In short, small-cap investing in 2025 matters because it combines valuation opportunity, diversification, and exposure to economic shifts that large caps cannot provide.

Best Practices for Small-Cap Investing in 2025

Small-cap investing requires discipline, but it also provides the chance to capture opportunities often missed by the broader market. Key practices include:

- Back strong leadership. Experienced management teams with high-performing cultures often drive resilience.

- Focus on fundamentals. Prioritize balance sheets, durable moats, and sustainable models.

- Diversify across sectors. Broader exposure reduces risk from industry cycles.

- Be patient with volatility. Small caps swing more than large caps, but those swings often open attractive entry points.

- Integrate ESG insights. Governance, values, and culture increasingly matter to long-term outcomes.

- Avoid speculative overexposure. Companies issuing heavy equity or carrying weak profitability often underperform.

- Work with seasoned managers. Firms like Ironwood Investment Management, LLC have decades of small-cap expertise and a proven process for uncovering value.

How Investors Can Apply Small-Cap Investing in 2025

Investors who want to benefit from small-cap potential must apply structure and perspective.

Before vs. After: Small-Cap Allocation Approach

| Without Valuation Focus | With Disciplined Small-Cap Approach |

| Following headlines and momentum | Identifying undervalued, overlooked companies |

| Overconcentration in mega-caps | Diversification across 60–80 smaller holdings |

| Reacting emotionally to swings | Using volatility as an advantage |

Ironwood Investment Management, LLC offers a Small Cap Core (SCC) Strategy designed to balance risk and opportunity. The team focuses on High Ironwood-Quality (I-Q) companies with strong financials, durable competitive positions, and management teams capable of adapting over time.

Importantly, Ironwood’s SCC disciplined approach has been recognized. The Small Cap Core Strategy recently earned two PSN awards reflecting industry acknowledgment of its expertise in navigating complex environments.³

Monitoring and Improving Small-Cap Investing in 2025

To maximize results, small-cap investing requires regular monitoring and discipline:

- Compare performance against benchmarks such as the Russell 2000.

- Track risk measures like downside capture and active share.

- Revisit investment theses regularly.

- Leverage independent verification and professional guidance.

This monitoring ensures that small-cap allocations remain aligned with long-term objectives and continue to uncover opportunities even in shifting markets.

The Future of Small-Cap Investing in 2025

Small caps have not disappeared, they have been overshadowed by large-cap headlines. Yet even through this period, they have continued to deliver potential opportunities. With valuations near historic lows and market concentration at extremes, conditions point to an important role for small caps in the years ahead.

At Ironwood Investment Management, LLC, we believe small-cap investing in 2025 is not only relevant, it is essential for capturing diversification, innovation, and forward-looking value.

Ready to take the next step?

- 📥 Download Ironwood’s SCC latest 2025 Whitepaper [HERE]

- 📞 Book a Free Consultation with Ironwood Investment Management, LLC [HERE]

Additional Ways to Contact Us:

Phone: (617) 757-7600

Email: info@ironwoodfunds.com

Website: https://ironwoodinvestmentmanagement.com

People Also Ask (FAQ)

What is small-cap investing in 2025?

Small-cap investing in 2025 focuses on companies with market caps between $120 million and $7 billion.

Why is small-cap investing important in 2025?

Because small caps combine valuation opportunity, diversification, and innovation that large caps do not.

How can investors apply small-cap investing in 2025?

By focusing on fundamentals, diversifying, and using disciplined strategies.

How does Ironwood Investment Management, LLC help with small-cap investing?

Through its Small Cap Core Strategy, built on rigorous research and a focus on high-quality companies.

Footnotes

- “Why small caps may be poised for a rebound.” Morningstar, 9 Jan. 2025. https://www.morningstar.com.

- Fisher, Gregg S. “Small Caps Aren’t Dead: They’re Misunderstood.” Quent Capital, 2025, https://quentcapital.com/blog/small-caps-arent-dead-theyre-misunderstood.

- “PSN Top Guns.” PSN, Informa Financial Intelligence, 19 Aug. 2025. https://psn.fi.informais.com/.

Important Disclosures & Disclaimers

* Awarded August 19, 2025. PSN is not a client, and no compensation was paid or received in exchange for the ranking. Register for free to view the full PSN Top Guns recipient list and award methodology: PSN Top Guns: https://psn.fi.informais.com/.

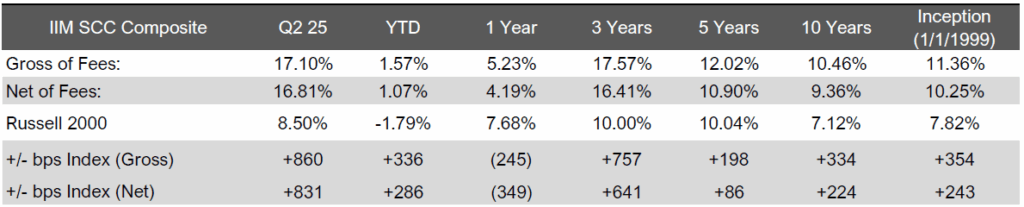

**August 31, 2025, Ironwood’s SCC performance compared to the S&P 500:

Performance Statistics – as of Q2 2025

This blog post is for informational purposes only and should not be construed as investment advice, a recommendation to buy or sell any security, or an offer of investment advisory services. All investments involve risk, including potential loss of principal. Past performance does not guarantee future results. Small-cap investments may be subject to higher volatility and additional risks compared to large-cap investments. Please consult with qualified financial professionals before making investment decisions. Ironwood Investment Management, LLC is a registered investment adviser. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Ironwood Investment Management®, LLC (Ironwood) is an independently managed investment advisory firm providing investment advisory services to institutional clients, mutual funds, and high-net-worth clients.

The firm is a registered investment adviser with the Securities and Exchange Commission. SEC Registration does not imply a certain level of skill or training.

Accounts in the Small Cap Core composite include separately managed, fully discretionary, fee-paying portfolios. Portfolios are invested in undervalued securities, the majority of which will have market capitalizations under $2.5 billion at cost, including securities with growth and/or value characteristics. Securities are considered undervalued when management believes the current share price does not accurately reflect the long-term economic value of the underlying company.

Ironwood Investment Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ironwood Investment Management, LLC has been independently verified for the periods January 1, 1999, through December 31, 2021. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

The Small Cap Core composite has had a performance examination for the periods July 1, 2002, to December 31, 2021. The verification and performance examination reports are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The creation date of the composite: July 2002. Performance inception date of the composite: January 1, 1999. Prior to July 2002, portfolios were included in the composite when at least 75% of the portfolio was invested in equity securities and when at least 75% of the portfolio was invested according to the investment style of the composite. Subsequent to July 2002, portfolios are included in the composite after the first full month of being fully invested.

Returns are presented gross and net of management fees and include the reinvestment of all income. Net returns are calculated based on the highest fee of 1.00%. Investment management fees are 1.00% on the first $25 million, 0.90% on the next $25 million, 0.80% on the next $50 million, and 0.75% over $100 million on an annual basis, and a client’s return will be reduced by these and other related expenses. The actual fee charged to an individual portfolio may vary by size and type of portfolio and may be negotiated. Actual investment advisory fees incurred by clients may vary.

The Russell 2000 Index consists of the 2000 smallest stocks in the Russell 3000 Index, representing approximately 8% of the U.S. equity market capitalization. The indices have been reconstituted annually since 1989. Ironwood returns and Index performance reflect reinvested interest income and dividends in U.S. dollars.

A list of composite descriptions and a list of limited distribution pooled fund descriptions are available upon request. Past performance is not indicative of future results. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. Prior to May 2006, the Firm was known as Ironwood Capital Management, LLC.

Past Performance is Not Indicative of Future Results

The performance data provided in this blog reflects past performance, which may not be representative of future results. Investing in small cap stocks and other securities involves substantial risk, including the potential loss of principal. There is no guarantee that any investment strategy will be successful.

Forward-Looking Statements

This blog contains forward-looking statements, including expectations or forecasts about the performance of the market and specific securities. These statements are based on Ironwood Investment Management, LLC’s current beliefs and expectations but are subject to change without notice. Actual results may differ materially from those expressed or implied due to various risks and uncertainties, including market conditions, economic factors, and changes in government policy.

No Offer or Solicitation

This blog is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities or investments. It is not intended to provide investment advice or to serve as a recommendation regarding any investment strategy. No client-adviser relationship is formed by reading this blog.

Conflicts of Interest

Ironwood Investment Management, LLC may hold positions in or recommend securities discussed in this blog. Clients should carefully review any investment strategy before committing to ensure it aligns with their investment objectives and risk tolerance.

Regulatory Disclosure

Ironwood Investment Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.