The Schwab IMPACT 2024 conference once again proved to be a premier event for financial professionals, and Ironwood Investment Management, LLC was proud to attend as a thought leader in the small-cap investment management space. This year’s conference provided a wealth of opportunities to connect, learn, and engage with industry peers while delving into emerging trends shaping the future of investment management. Our participation at Schwab IMPACT 2024 comes on the heels of our attendance at FutureProof in Huntington Beach, CA.

Continued Thought Leadership and Commitment to Lasting Connections

Ironwood’s attendance at Schwab IMPACT 2024 showcases our dedication to staying ahead of industry trends, maintaining long-standing relationships, and forging new connections. Conferences like Schwab IMPACT allow us to exchange ideas with other innovators, deepen our understanding of market dynamics, and remain attuned to the evolving needs of advisors and investors. With decades of experience in the small-cap space, Ironwood’s presence at events like these reinforces our role as a trusted partner and thought leader in navigating the complexities of small-cap investing.

Hot Theme: AI in Investment Management

One of the key themes at this year’s conference was the continued influence of artificial intelligence (AI) in transforming the investment management landscape. Firms are leveraging AI to streamline operations, reduce servicing costs, and enhance client service. From using predictive analytics to identify market trends to automating routine tasks, AI is reshaping how firms interact with clients and manage portfolios.

For Ironwood, AI represents an opportunity to refine our client-service processes without compromising the hands-on approach that defines us. While AI provides valuable tools for efficiency, we believe it is best complemented by the expertise, judgment, and intuition of seasoned investment professionals. See more about our views on Ethical AI here.

Active Management: Essential in Small Caps

While ETFs and index funds continue to dominate industry discussions, we at Ironwood believe in the critical role active management can play in the small-cap sector. Small-cap stocks often operate in niche markets with limited coverage, creating inefficiencies that active managers can exploit. Additionally, volatility can play a larger role in the market movement of small cap stocks, which is a trend we believe can benefit us as an active manager.

Ironwood’s rigorous, research-driven approach ensures we uncover and capitalize on opportunities that passively managed funds may miss. By focusing on “High IQ” companies—those with strong management, sound financials, and promising growth potential—we deliver strategies that prioritize long-term success over one-size-fits-all solutions. We believe our active approach and philosophy can be particularly impactful in the small-cap sector, where nuanced insights and timely decisions can yield superior results.

Looking Ahead

Schwab IMPACT 2024 reinforced the importance of adaptability, collaboration, and innovation in today’s dynamic investment landscape. Ironwood remains committed to leveraging cutting-edge insights, building strong relationships, and staying true to our core philosophy. With over two decades of experience and a lasting track record in the small cap space, we’re excited to launch into 2025.

As always, we are grateful for the chance to connect with industry peers, share our expertise, and gain new perspectives. Together, we look forward to another year of driving success for our clients in the ever-dynamic small-cap market.

Deepen Your Small-Cap Expertise with Ironwood

Schwab IMPACT 2024 highlighted the evolving landscape of investment management. Consider partnering with Ironwood Investment Management, LLC to navigate this complexity and deliver exceptional client results. We offer:

- Proven Small-Cap Strategies: Access our actively managed, research-driven strategies to identify high-potential small-cap companies.

- Dedicated Advisor Support: Benefit from our commitment to building long-term relationships with advisors, providing personalized support and resources to help you succeed.

- Thought Leadership and Insights: Stay informed with our latest research, market commentary, and insights on the small-cap market.

Want to learn more about how Ironwood can help you achieve your clients’ investment goals?

Connect with an Ironwood representative today!

PERFORMANCE DATA AND DISCLOSURES

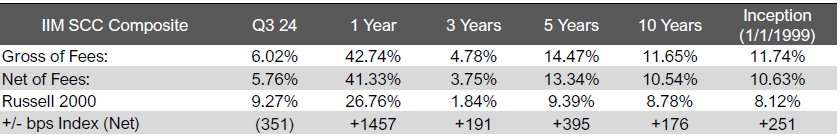

Performance Statistics as of 9/30/2024

Ironwood Investment Management®, LLC (Ironwood) is an independently managed investment advisory firm providing investment advisory services to institutional clients, mutual funds and high-net-worth clients. The firm is a registered investment adviser with the Securities and Exchange Commission. SEC Registration does not imply a certain level of skill or training. Accounts in the Small Cap Core composite include separately managed, fully discretionary, fee-paying portfolios. Portfolios are invested in undervalued securities, the majority of which will have market capitalizations under $2.5 billion at cost, including securities with growth and/or value characteristics. Securities are considered undervalued when management believes the current share price does not accurately reflect the long-term economic value of the underlying company. Ironwood Investment Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ironwood Investment Management, LLC has been independently verified for the periods January 1, 1999 through December 31, 2021. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Small Cap Core composite has had a performance examination for the periods July 1, 2002 to December 31, 2021. The verification and performance examination reports are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. The creation date of the composite: July 2002. Performance inception date of the composite: January 1, 1999. Prior to July 2002, portfolios were included in the composite when at least 75% of the portfolio was invested in equity securities and when at least 75% of the portfolio was invested according to the investment style of the composite. Subsequent to July, 2002, portfolios are included in the composite after the first full month of being fully invested. Returns are presented gross and net of management fees and include the reinvestment of all income. Net returns are calculated based on the highest fee of 1.00%. Investment management fees are 1.00% on the first $25 million, 0.90% on the next $25 million, 0.80% on the next $50 million, and 0.75% over $100 million on an annual basis and a client’s return will be reduced by these and other related expenses. The actual fee charged to an individual portfolio may vary by size and type of portfolio and may be negotiated. Actual investment advisory fees incurred by clients may vary. The Russell 2000 Index consists of the 2000 smallest stocks in the Russell 3000 Index that represents approximately 8% of the U.S. equity market capitalization. The indices have been reconstituted annually since 1989. Ironwood returns and Index performance reflect reinvested interest income and dividends, in U.S. dollars. A list of composite descriptions and a list of limited distribution pooled fund descriptions are available upon request. Past performance is not indicative of future results. Policies for valuing investments, calculating performance and preparing GIPS Reports are available upon request. Prior to May 2006, the Firm was known as Ironwood Capital Management, LLC.