“It is possible to have too much of a good thing” Aesop

The stock market rally that started in the fall of 2022 continued into the first quarter of 2024. The S&P 500 was up 10.56% in the quarter, and the Russell 2000 (the leading index of smaller US companies) advanced 5.18%. These indexes have now advanced 46.6% and 27.62%, respectively, since the rally began and are trading near all-time highs. Recently, however, the stock market has experienced a pullback that is challenging the persistence of the seventeen-month-old rally.

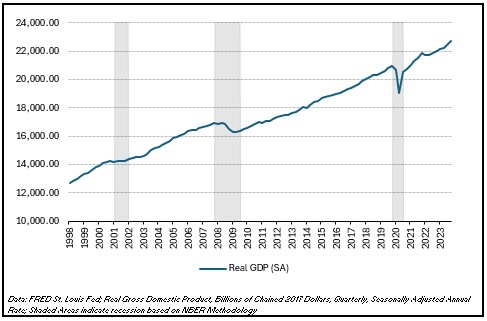

The US economy has proven to be surprisingly resilient the past few years. It has grown steadily despite geopolitical turmoil, an inflationary spiral, and the most rapid increase in short-term interest rates in history. The interest rate increase has confounded economic forecasters, who theorized that high interest rates would cripple the economy and trigger a recession. High rates and geopolitical problems have adversely impacted economies in Europe and China, but the US economy has managed to plow ahead pretty much unscathed, as the chart below of GDP demonstrates.

Even though the International Monetary Fund (IMF) estimates that $3.3 trillion in global economic output has been lost since the pandemic began in 2020, the US economy has bucked this trend and is now larger than it was in early 2020. Based on the economy’s continued strength, the IMF recently increased its estimate for global economic growth in 2024 to 3.2%, up from a forecasted 2.9% in October. The below chart is a graphical representation of this trend.

Thanks to this vigorous growth, the US economy is creating an average of 225,000 jobs per month and continues to operate near full employment. But the strength of the economy is also contributing to a few unwelcome side effects, most notably inflation.

Inflation skyrocketed in the initial pandemic recovery period due to a brisk recovery in demand colliding with a supply chain bottleneck. It hit a peak of 9% in 2021, prompting the Federal Reserve (the Fed) to aggressively move to a restrictive monetary policy by rapidly increasing short-term interest rates. As supply-and-demand dynamics normalized, and the Fed’s policies had their effect, inflation rates quickly declined. With inflation approaching the Fed’s target rate of 2%, optimism grew that the Fed would indeed achieve a soft landing for the economy and would soon begin cutting rates. However, in recent months the decline in inflation as measured by the Consumer Price Index (CPI) appears to have bottomed out at about 2.78%. The following graph demonstrates this trend. Consequently, the timetable for the Fed to begin reducing rates has been pushed out to later in the year.

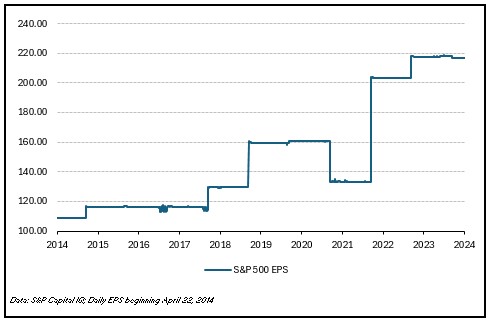

There is a strong correlation between interest rates and stock prices, and the expectation of higher rates for a longer time period has begun to weigh on the equity markets. Offsetting the impact of higher rates is the outlook for corporate profits, which are getting a boost from all the robust economic activity. First quarter earnings are coming out, and so far, it appears that most companies will meet or beat expectations. The below chart shows the growth in earnings per share of the S&P 500 over the last ten years. Looking forward, corporate profits are estimated to grow by 10% in 2024, 14% in 2025, and 11% in 2026.

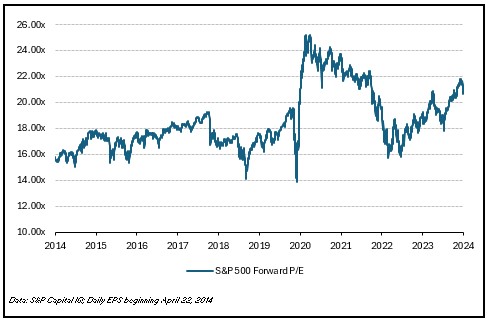

This rosy outlook for corporate profits is reflected in the elevated level of P/E (price-to-earning) ratios. The forward P/E for the S&P 500 is 21x, about one standard deviation above the long-term average, which is exhibited in the below graph.

The interplay of economic activity, inflation, and interest rates will likely determine the fate of the stock market over the balance of the year. If economic growth is too strong, we could have too much of a good thing, putting upward pressure on inflation. The Fed will be inclined to keep rates higher for longer, which will ultimately weigh on economic growth and stock prices. Barring any big surprise, it appears that the US stock markets will be locked in a tug of war between growing corporate profits on the one hand and the prospect of high interest rates on the other.

Given the poor record of economic forecasts in recent years, one should view the current one with a fair degree of skepticism. It would appear that the Fed’s program to tame inflation will have a pronounced impact on the economy and the financial markets for at least the next few quarters. While this increased uncertainty might be unsettling to investors, it is important to keep a longer-term perspective. The US economy is fundamentally strong, corporate profits are growing, and the valuation for many US companies appears to be quite reasonable.

Sincerely,