Introduction

The recent correction in the small cap stock market has sparked a key question for investors: is this a potential buying opportunity or the start of a longer-term bear market? With the Russell 2000 Index experiencing a low double-digit decline year-to-date and down approximately 18% from its peak in November, small cap equities have felt the weight of market uncertainty.

However, history shows that periods of market stress often create potential opportunities for disciplined investors. In fact, according to a recent LinkedIn poll conducted by Ironwood Investment Management, LLC, 100% of respondents believe the current market decline represents a buying opportunity—a strong signal of investor sentiment despite ongoing volatility. View the poll here

At Ironwood Investment Management, LLC, we remain focused on identifying high-quality small cap companies with strong fundamentals. Through our High Ironwood-Quality (High I-Q) investing framework, we aim to uncover potential value in turbulent markets. In this blog, we explore the current environment, assess the landscape for small cap investments, and discuss how a disciplined approach may help investors navigate ongoing market fluctuations.

Understanding the Small Cap Stocks Market Correction

Market downturns are driven by various factors, including macroeconomic concerns, interest rate fluctuations, and shifts in investor sentiment. The recent correction reflects concerns about economic growth, inflationary pressures, and tightening monetary policy. However, small cap stocks, which often experience amplified price swings, may be positioned for potential long-term opportunities.

Historically, small cap stocks tend to be more volatile than their large-cap counterparts, but they have also demonstrated periods of strong rebounds following downturns. This pattern suggests that while short-term uncertainty remains, disciplined investors could potentially benefit from market dislocations.

Why Small Cap Stocks May Present a Potential Opportunity

1. Attractive Valuations

The recent decline in small cap stock prices has led to more compelling valuations relative to historical norms. The Russell 2000, which serves as a benchmark for small cap stocks, has seen a notable pullback. As a result, many high-quality small cap companies may now be trading at attractive entry points.

2. Potential for Future Growth

While economic conditions remain uncertain, small cap companies often have a higher potential for growth compared to large-cap firms. Many small businesses are in their early expansion phases, with opportunities to scale and increase market share over time. A market correction can provide opportunities to invest in these businesses at potentially favorable valuations.

3. Market Cycles Favor Long-Term Investors

Market cycles are inevitable, and corrections often create entry points for investors with a long-term horizon. Historically, small cap stocks have exhibited stronger recoveries following periods of downturns, making them a compelling area for investors looking beyond short-term fluctuations.

4. Unlocking Value Through High I-Q Investing

Ironwood Investment Management, LLC has carved out a unique niche in small-cap investing with a focus on its proprietary High Ironwood-Quality, or “High I-Q” companies framework. This research-driven approach identifies companies with strong leadership, financial stability, and long-term growth potential. Learn more about our High I-Q investing philosophy here.

Risks to Consider When Investing in Small Cap Stocks

While the potential opportunities in small cap stocks are compelling, it is essential to acknowledge the risks. Small cap stocks tend to be more volatile, have lower liquidity, and may face greater challenges during economic slowdowns. Investors should take a disciplined approach and consider factors such as company fundamentals, competitive positioning, and financial health before making investment decisions.

At Ironwood Investment Management, LLC, our investment philosophy emphasizes research-driven stock selection and risk management. By identifying companies with solid balance sheets, strong management teams, and long-term competitive advantages, we aim to navigate volatility while seeking potential opportunities in the small cap space.

Partner with Ironwood Investment Management, LLC

As market volatility continues to shape the investment landscape, investors need a strategy grounded in deep research, disciplined risk management, and a long-term perspective. At Ironwood Investment Management, LLC, we specialize in identifying small cap companies that may present potential opportunities amid market corrections.

Our expertise in navigating market cycles, combined with our focus on fundamental analysis, positions us uniquely to assess valuation shifts and emerging investment trends. Whether you’re looking for exposure to resilient small cap companies, sectors poised for recovery, or high-quality businesses that can withstand economic uncertainty, our investment approach is designed to identify potential opportunities in a dynamic market environment.

To learn more about our investment strategies, please contact Ironwood Investment Management, LLC:

📞 Phone: (617) 757-7600

📧 Email: info@ironwoodfunds.com

🌐 Website: Ironwood Investment Management, LLC

Let’s explore how Ironwood can help you navigate market volatility and identify small cap opportunities in 2025 and beyond.

Important Disclosures & Disclaimers

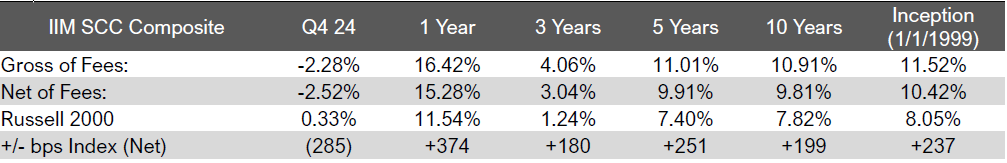

Performance Statistics – as of Q4 2024

Ironwood Investment Management®, LLC (Ironwood) is an independently managed investment advisory firm providing investment advisory services to institutional clients, mutual funds, and high-net-worth clients.

The firm is a registered investment adviser with the Securities and Exchange Commission. SEC Registration does not imply a certain level of skill or training.

Accounts in the Small Cap Core composite include separately managed, fully discretionary, fee-paying portfolios. Portfolios are invested in undervalued securities, the majority of which will have market capitalizations under $2.5 billion at cost, including securities with growth and/or value characteristics. Securities are considered undervalued when management believes the current share price does not accurately reflect the long-term economic value of the underlying company.

Ironwood Investment Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ironwood Investment Management, LLC has been independently verified for the periods January 1, 1999, through December 31, 2021. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

The Small Cap Core composite has had a performance examination for the periods July 1, 2002, to December 31, 2021. The verification and performance examination reports are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The creation date of the composite: July 2002. Performance inception date of the composite: January 1, 1999. Prior to July 2002, portfolios were included in the composite when at least 75% of the portfolio was invested in equity securities and when at least 75% of the portfolio was invested according to the investment style of the composite. Subsequent to July 2002, portfolios are included in the composite after the first full month of being fully invested.

Returns are presented gross and net of management fees and include the reinvestment of all income. Net returns are calculated based on the highest fee of 1.00%. Investment management fees are 1.00% on the first $25 million, 0.90% on the next $25 million, 0.80% on the next $50 million, and 0.75% over $100 million on an annual basis, and a client’s return will be reduced by these and other related expenses. The actual fee charged to an individual portfolio may vary by size and type of portfolio and may be negotiated. Actual investment advisory fees incurred by clients may vary.

The Russell 2000 Index consists of the 2000 smallest stocks in the Russell 3000 Index, representing approximately 8% of the U.S. equity market capitalization. The indices have been reconstituted annually since 1989. Ironwood returns and Index performance reflect reinvested interest income and dividends in U.S. dollars.

A list of composite descriptions and a list of limited distribution pooled fund descriptions are available upon request. Past performance is not indicative of future results. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. Prior to May 2006, the Firm was known as Ironwood Capital Management, LLC.

Past Performance is Not Indicative of Future Results

The performance data provided in this blog reflects past performance, which may not be representative of future results. Investing in small cap stocks and other securities involves substantial risk, including the potential loss of principal. There is no guarantee that any investment strategy will be successful.

Forward-Looking Statements

This blog contains forward-looking statements, including expectations or forecasts about the performance of the market and specific securities. These statements are based on Ironwood Investment Management, LLC’s current beliefs and expectations but are subject to change without notice. Actual results may differ materially from those expressed or implied due to various risks and uncertainties, including market conditions, economic factors, and changes in government policy.

No Offer or Solicitation

This blog is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities or investments. It is not intended to provide investment advice or to serve as a recommendation regarding any investment strategy. No client-adviser relationship is formed by reading this blog.

Conflicts of Interest

Ironwood Investment Management, LLC may hold positions in or recommend securities discussed in this blog. Clients should carefully review any investment strategy before committing to ensure it aligns with their investment objectives and risk tolerance.

Regulatory Disclosure

Ironwood Investment Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.