The investment landscape is shaped by the quality of research, a disciplined process, and the ability to evaluate opportunities through changing market conditions. Ironwood Investment Management, LLC’s Small Cap Core strategy was named a PSN Top Gun for both the quarter and the three year period ending September 30, 2025, within the PSN Small Cap Core Universe, which includes 125 firms and 155 products.*

For allocators assessing small cap strategies, third party analytics platforms can offer valuable context on how managers apply their philosophies in real world environments. This recognition reflects Ironwood’s long standing emphasis on research depth, consistency, and a disciplined investment approach.

This blog explores the broader context around PSN Top Guns, the drivers behind Ironwood’s Small Cap Core philosophy, and the potential opportunities the small cap universe continues to offer thoughtful long term investors.

Market Context for Small Cap Investors

Small cap companies often operate in highly dynamic business environments. Innovation cycles, expanding market share, and pricing inefficiencies can create potential opportunities for long term allocators². Because these companies frequently receive less analyst coverage than larger peers, valuations can vary widely, at times influenced by short term sentiment rather than long term business fundamentals.

For investment teams experienced in fundamental research, these characteristics may offer a compelling landscape for identifying potential value. Ironwood’s Small Cap Core strategy was designed with these dynamics in mind, applying a bottom up research process to evaluate companies with durable business models, strong financial profiles, and strategic resilience.

Understanding PSN and Its Top Guns Recognition

PSN, a well known institutional manager database, evaluates products and strategies across asset classes using quantitative criteria and structured peer universes³. Its Top Guns designation is based on predetermined methodology, risk adjusted measurements, and peer comparison metrics.

Ironwood’s Small Cap Core strategy was named a PSN Top Gun for both the quarter and the three year period ending September 30, 2025, within the PSN Small Cap Core Universe, which includes 125 firms and 155 products⁴.

This acknowledgment does not imply future results. Rather, it reflects how the strategy’s historical data aligned with PSN’s screening criteria for the specified periods. For allocators, third party recognitions such as PSN Top Guns can offer an additional lens through which to evaluate investment processes, compare peer groups, and assess potential indicators of consistency.

How Ironwood Approaches Small Cap Core Investing

A central belief guiding Ironwood’s Small Cap Core philosophy is that high quality, fundamentally strong companies can create long term shareholder value². This belief is expressed through Ironwood’s focus on identifying High Ironwood Quality, or High I Q companies, which generally exhibit:

- Experienced and disciplined management teams

- Solid financial foundations

- Scalable and durable business models

- Differentiated competitive positioning

- Thoughtful attention to material environmental, social, and governance considerations

Ironwood’s Small Cap Core investment team integrates quantitative screening tools with qualitative judgment, building on decades of accumulated insights. This blended approach supports a portfolio construction discipline designed to reflect long term perspective, a performance track record, and a commitment to research driven analysis⁵.

Why Third Party Recognition Matters to Investors

Allocators rely on a combination of qualitative and quantitative analysis when evaluating investment managers. While no third party designation should serve as a sole basis for decision making, recognitions such as PSN Top Guns can:

- Provide independent, data driven context

- Highlight consistency relative to defined peer groups

- Enhance due diligence by adding structure to peer comparisons

As with any quantitative ranking, PSN Top Guns reflects defined historical data periods and does not predict future results. It serves as an additional tool within a broader evaluation framework.

Potential Opportunities in the Small Cap Universe

The small cap universe continues to evolve as companies adapt to new technologies, regulatory changes, and shifting consumer behaviors. Within this landscape, potential opportunities may arise from:

- Innovation and product expansion

- Strengthening competitive positioning

- Market share gains or geographic expansion

- Operational improvements and enhanced efficiencies

Ironwood’s Small Cap Core investment team evaluates these developments through continuous research, direct company engagement, and a risk aware portfolio construction framework built to balance opportunity with discipline.

Why Work with Ironwood Investment Management, LLC

Ironwood Investment Management, LLC brings a long standing commitment to a repeatable investment process, disciplined fundamental research, and alignment with client objectives. The firm remains independently owned, with a team structure that emphasizes stewardship, accountability, and long term thinking.

For investors seeking a thoughtful approach to small cap equities, Ironwood offers:

- A rigorous, research driven philosophy refined over decades

- A structured process centered on identifying High I Q companies

- A team with continuity and deep domain expertise

- A performance track record shaped across multiple market cycles

- Institutional grade operational foundations

Call to Action

To learn more about Ironwood Investment Management, LLC’s Small Cap Core strategy, investment philosophy, or the PSN Top Guns methodology, we invite you to connect with our team.

Contact Ironwood Investment Management, LLC

📞 Phone: 617-757-7600

📧 Email: info@ironwoodfunds.com

🌐 Website: www.ironwoodinvestmentmanagement.com

Footnotes

¹ PSN database overview and screening framework.

² Ironwood Investment Management, LLC Small Cap Core philosophy, see Strategy Presentation.

³ PSN methodology documentation for peer universe construction.

⁴ Data provided: PSN Small Cap Core Universe, quarter and three year period ending September 30, 2025.

⁵ Ironwood Investment Management, LLC investment process, including High I Q framework.

*PSN Top Guns recognition awarded November 18, 2025. PSN is not a client, and no compensation was paid or received in exchange for the ranking. Register for free to view the full PSN Top Guns recipient list and award methodology: https://psn.fi.informais.com/

People Also Ask

1. What is the PSN Top Gun Small Cap Core designation?

The PSN Top Gun Small Cap Core designation is a quantitative recognition based on PSN’s predefined screening criteria for strategies within its Small Cap Core Universe.

2. How does Ironwood’s Small Cap Core strategy approach investing?

Ironwood’s Small Cap Core strategy uses bottom up fundamental research to identify High I Q companies with durable business models and potential long term opportunities.

3. Why do allocators review PSN Top Guns?

Allocators review PSN Top Guns to gain peer group context, evaluate consistency, and supplement due diligence with standardized quantitative criteria.

4. What potential opportunities exist in small cap equities?

Potential opportunities may arise from innovation, product expansion, margin improvements, and valuation inefficiencies across the small cap landscape.

Important Disclosures & Disclaimers

* Awarded November 18, 2025. PSN is not a client, and no compensation was paid or received in exchange for the ranking. Register for free to view the full PSN Top Guns recipient list and award methodology: PSN Top Guns: https://psn.fi.informais.com/.

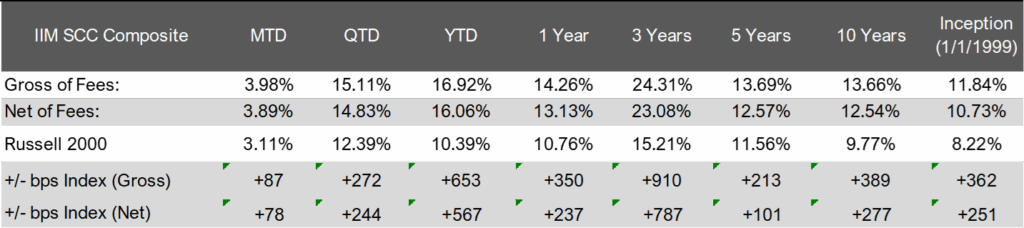

Performance Statistics – as of Q3 2025

This blog post is for informational purposes only and should not be construed as investment advice, a recommendation to buy or sell any security, or an offer of investment advisory services. All investments involve risk, including potential loss of principal. Past performance does not guarantee future results. Small-cap investments may be subject to higher volatility and additional risks compared to large-cap investments. Please consult with qualified financial professionals before making investment decisions. Ironwood Investment Management, LLC is a registered investment adviser. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Ironwood Investment Management®, LLC (Ironwood) is an independently managed investment advisory firm providing investment advisory services to institutional clients, mutual funds, and high-net-worth clients.

The firm is a registered investment adviser with the Securities and Exchange Commission. SEC Registration does not imply a certain level of skill or training.

Accounts in the Small Cap Core composite include separately managed, fully discretionary, fee-paying portfolios. Portfolios are invested in undervalued securities, the majority of which will have market capitalizations under $2.5 billion at cost, including securities with growth and/or value characteristics. Securities are considered undervalued when management believes the current share price does not accurately reflect the long-term economic value of the underlying company.

Ironwood Investment Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ironwood Investment Management, LLC has been independently verified for the periods January 1, 1999, through December 31, 2021. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

The Small Cap Core composite has had a performance examination for the periods July 1, 2002, to December 31, 2021. The verification and performance examination reports are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The creation date of the composite: July 2002. Performance inception date of the composite: January 1, 1999. Prior to July 2002, portfolios were included in the composite when at least 75% of the portfolio was invested in equity securities and when at least 75% of the portfolio was invested according to the investment style of the composite. Subsequent to July 2002, portfolios are included in the composite after the first full month of being fully invested.

Returns are presented gross and net of management fees and include the reinvestment of all income. Net returns are calculated based on the highest fee of 1.00%. Investment management fees are 1.00% on the first $25 million, 0.90% on the next $25 million, 0.80% on the next $50 million, and 0.75% over $100 million on an annual basis, and a client’s return will be reduced by these and other related expenses. The actual fee charged to an individual portfolio may vary by size and type of portfolio and may be negotiated. Actual investment advisory fees incurred by clients may vary.

The Russell 2000 Index consists of the 2000 smallest stocks in the Russell 3000 Index, representing approximately 8% of the U.S. equity market capitalization. The indices have been reconstituted annually since 1989. Ironwood returns and Index performance reflect reinvested interest income and dividends in U.S. dollars.

A list of composite descriptions and a list of limited distribution pooled fund descriptions are available upon request. Past performance is not indicative of future results. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. Prior to May 2006, the Firm was known as Ironwood Capital Management, LLC.

Past Performance is Not Indicative of Future Results

The performance data provided in this blog reflects past performance, which may not be representative of future results. Investing in small cap stocks and other securities involves substantial risk, including the potential loss of principal. There is no guarantee that any investment strategy will be successful.

Forward-Looking Statements

This blog contains forward-looking statements, including expectations or forecasts about the performance of the market and specific securities. These statements are based on Ironwood Investment Management, LLC’s current beliefs and expectations but are subject to change without notice. Actual results may differ materially from those expressed or implied due to various risks and uncertainties, including market conditions, economic factors, and changes in government policy.

No Offer or Solicitation

This blog is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities or investments. It is not intended to provide investment advice or to serve as a recommendation regarding any investment strategy. No client-adviser relationship is formed by reading this blog.

Conflicts of Interest

Ironwood Investment Management, LLC may hold positions in or recommend securities discussed in this blog. Clients should carefully review any investment strategy before committing to ensure it aligns with their investment objectives and risk tolerance.

Regulatory Disclosure

Ironwood Investment Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.