The Great Rotation, A Broader Market Rally

As we step into the fourth quarter of 2024, the investment landscape has shifted, bringing with it new opportunities and challenges. The Federal Reserve, after months of anticipation, has finally begun to cut interest rates, marking a turning point in monetary policy. The Fed’s 50 basis-point reduction in September comes as inflation has steadily declined, now nearing the Fed’s long-term target of 2%. For investors, this pivot sets the stage for a new phase of economic growth, and with it, the emergence of a broader market rally.

In recent years, the U.S. stock market has been largely driven by mega-cap growth names, particularly in the technology sector. Financial media has covered the success of the “Magnificent Seven” tech stocks at great length. However, as we move through 2024, the rally is broadening—a trend that signals a “great rotation” within the market. The best-performing stocks in the third quarter were not surprisingly beneficiaries of declining interest rates such as Banks, Utilities, Real Estate, Small Cap and Value stocks. This shift has been fueled by declining borrowing costs and a more favorable environment for businesses that benefit from lower rates. For example, banks, real estate, and utilities all benefit from reduced financing costs. Small-cap stocks, which are often more sensitive to macroeconomic shifts, have also begun to outperform as the broader market turns its attention to these often-overlooked areas.

While the rally has broadened, it is important to note that stock valuations are creeping toward the higher end of historical ranges. The S&P 500 (an index of 500 large companies) is now trading at an estimated price-to-earnings (P/E) ratio of 25x for 2024, with expectations for 2025 coming in at 22x. By comparison, the longer-term historical average for the S&P 500 is closer to 18x. This suggests that large-cap stocks are becoming more expensive, which could limit future gains.

In contrast, the valuation of broader market indices such as the Russell 2000 Index (an index of 2000 small companies) are closer to long-term averages based upon estimated earnings for 2025. Not only are these companies trading at lower estimated multiples, but forecasted earnings are projected to grow at a faster pace than their large-cap counterparts. Earnings for the S&P 500 are projected to increase by 10% in 2024 and 13% in 2025 while estimated earnings for the Russell 2000 are expected to increase by 3% in 2024 and 36% in 2025. For investors seeking value, looking beyond the Magnificent Seven presents some interesting opportunities. At Ironwood, our research efforts are increasingly focused on identifying these underappreciated companies that have been passed over in the recent market rally.

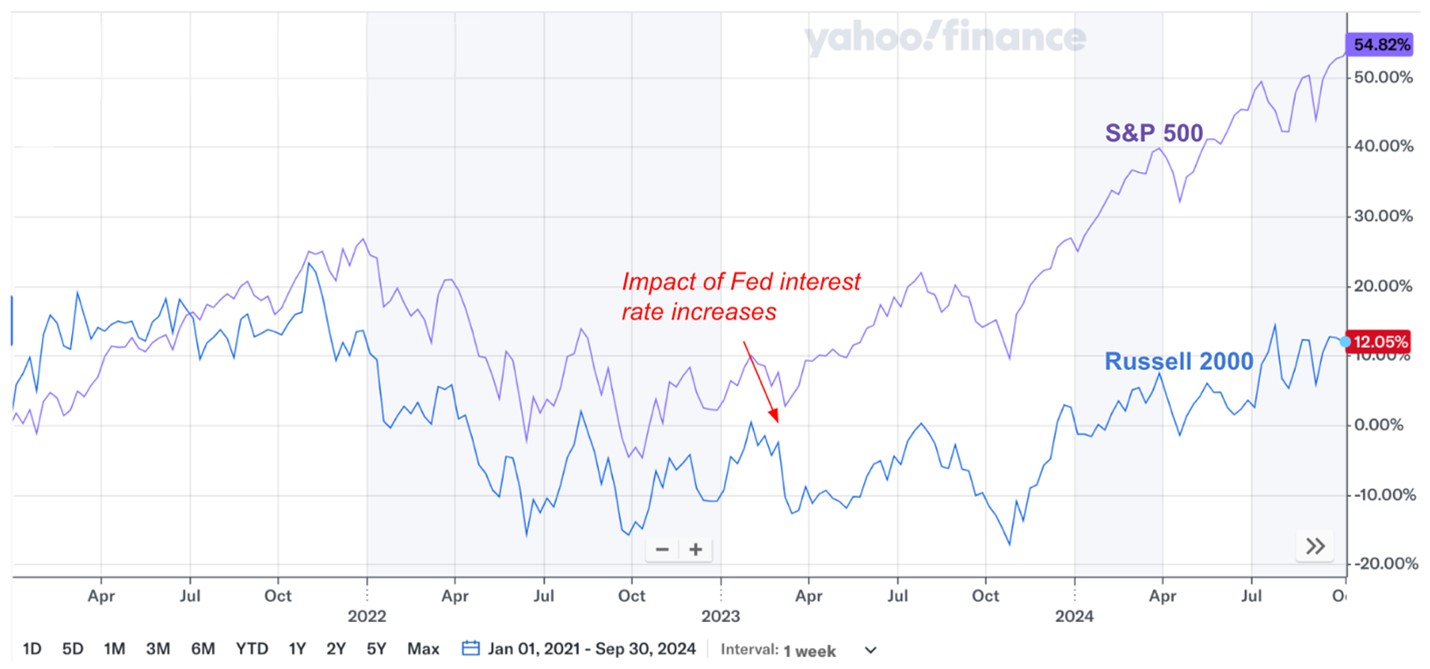

The chart below shows the divergent performance in the recent market rally. We observe that as the Fed raised rates dramatically in 2022 and 2023 (from 0.08% in Jan 2022 to a high of 5.33% in August 2023), the S&P500 outperformed the Russell 2000. The graph illustrates the point above: large cap stocks have risen significantly, whereas small caps have not experienced the same appreciation in this recent rally.

Russell 2000 vs. S&P 500 – Jan 1, 2021 through Sep 30, 2024 (Source: yahoo finance as of 10/24/2024)

Despite the ongoing geopolitical challenges, the U.S. economy continues to grow at a steady pace. Gross Domestic Product is estimated to have grown 3.3% in the third quarter of 2024.[1] The International Monetary Fund projects US gross domestic product to expand 2.5% in the fourth quarter from a year earlier. And Gross domestic product is estimated to grow by 2.6% for 2024 overall. For 2025, the IMF projects the US economy to grow 1.9%. Job creation, an important contributor to economic strength, continues at a strong pace, with non-farm payroll jobs increasing by 254,000 in September, well above the average monthly gain of 203,000 jobs over the prior 12 months. Unemployment also continues near historical lows of 4.1% in September, marginally higher than a year earlier at 3.8%, and still within the range that economists consider “Full Employment” in the economy.[2] Corporate earnings also continue to show strong growth with UBS, the wealth manager, expecting 11% corporate earnings growth in full year 2024[3], underscoring the fundamental health of the economy. The upcoming election, while a topic of heated debate, is not expected to significantly impact market direction, regardless of the outcome. Overall, the economic foundation appears solid, with key indicators pointing to continued growth.

The outlook for the remainder of 2024 and into 2025 is bolstered by the expectation of further interest rate cuts. Current market estimates point to a 25bps rate cut at the November 2024 Fed meeting, with a slimmer chance of a larger 50bps reduction. As inflation moderates and the Fed shifts to a more accommodative stance, the environment for corporate profitability improves. Companies that struggled under higher borrowing costs will likely find relief in the months ahead, potentially spurring additional investment and expansion.

As we look to the future, our investment strategy at Ironwood remains clear: we are committed to finding value in companies that have been overlooked by the broader market. While large-cap growth stocks have dominated headlines in recent years, many high-quality businesses have been left behind. These companies, now trading at what would appear to be reasonable valuations, present significant upside potential as the economic environment continues to evolve.

At Ironwood, we are actively researching these opportunities, focusing on businesses with strong fundamentals, healthy balance sheets, and the potential to benefit from declining interest rates. Our investment philosophy is rooted in deep research, patience, and a long-term perspective. We believe that by staying true to these principles, we can continue to deliver good returns to our clients, even in a rapidly changing market. Our disciplined approach to investment remains unchanged — we are patient, we are prudent, and we are always looking for value where others may not see it.

In summary, the U.S. economy appears to be in good shape, with corporate earnings growing and interest rates poised to decline further. The market may face headwinds as valuations rise, but there are still many good companies that present attractive investment opportunities. Our research efforts are focused on finding these opportunities, and we are confident that this approach will continue to serve our clients well in the months ahead.

We look forward to navigating the rest of 2024 with you, as we continue to seek out the best investment opportunities in this evolving landscape.

[1] Estimate according to the Federal Reserve Bank of Atlanta as of October 25, 2024. https://www.atlantafed.org/cqer/research/gdpnow

[2] U.S. Bureau of Labor Statistics, “September Employment Situation Summary”, accessed October 25, 2024. https://www.bls.gov/news.release/empsit.nr0.htm

[3] UBS, “Corporate earnings are solid amid a resilient US economy”, accessed October 25, 2024. https://www.ubs.com/global/en/wealth-management/who-we-serve/marketnews/article.1580279.html

Sincerely,