Introduction: Trade Policy Shifts and the New Investment Landscape

The global investment landscape is evolving rapidly as trade policy becomes increasingly dynamic. From tariffs and reshoring to protectionist stances and global realignments, these shifts are forcing investors to re-evaluate the fundamentals that drive small-cap performance. The central question is: What should investors prioritize when evaluating small caps during these trade policy transitions?

While large-cap multinationals often dominate headlines, small-cap companies—known for their agility and niche focus—may present potential opportunities for discerning investors in times of change. However, not all small caps are equally equipped to navigate such volatility.

The Trade Policy Landscape: Why It Matters to Small Caps

Recent years have seen a pronounced move toward protectionist policies, including reshoring of supply chains, enforcement of tariffs, and reevaluation of international trade agreements. The U.S.-China trade dynamics and incentives under the CHIPS Act and Inflation Reduction Act are reshaping how companies operate globally.

For small caps, which tend to have fewer international dependencies but also less cushion for absorbing external shocks, these trade shifts present both risks and potential opportunities. Small caps that are strategically positioned—geographically and operationally—can respond with agility, but resilience still requires careful evaluation.

Related Read: Tariff Impact on Small Cap Stocks: Strategic Insights for 2025 explores how evolving tariff regimes are shaping sector-specific risks and opportunities for small-cap investors.

Domestic Supply Chain Strength: A Competitive Advantage

In an era of rising tariffs and logistics uncertainty, a strong domestic supply chain has become a key differentiator. Companies that rely on local or regional suppliers may be better positioned to:

- Mitigate tariff-related cost volatility

- Reduce transportation risks and delays

- Capitalize on government incentives tied to local sourcing

For example, U.S.-based industrials, food manufacturers, and construction supply firms often benefit from proximity to end-markets and faster inventory cycles. For small caps in these sectors, operational efficiency and flexibility in sourcing can be crucial markers of durability.

Ironwood Investment Management, LLC, recognizes the value of evaluating supplier networks during its bottom-up research process, particularly as supply chain agility becomes a strategic necessity in the current climate.

Adaptable Leadership: Navigating Uncertainty with Strategic Vision

Periods of trade upheaval call for more than just operational readiness—they require leadership that can respond to new regulations, pivot supply lines, and reimagine business models.

At Ironwood Investment Management, LLC, the emphasis on investing in High I-Q companies reflects this principle. These firms are led by management teams with:

- Entrepreneurial vision and experience

- Deep understanding of their industry’s regulatory landscape

- The ability to make swift, strategic decisions when faced with change

Adaptable leadership plays a pivotal role in not only steering through uncertainty but also seizing new potential opportunities that arise from changing policies. As CIO Don Collins puts it, “We believe Ironwood-Quality companies have a higher probability of thriving, not just surviving.”

What to Look for: A Small Cap Evaluation Checklist

To assess a company’s resilience during trade policy transitions, investors can benefit from a structured framework. Key areas to examine include:

- Geographic revenue concentration: Does the business rely heavily on regions with heightened trade tensions?

- Input sourcing flexibility: Can the company pivot its supply chain to alternative domestic or regional sources?

- Capital structure and cash flow stability: Is the firm financially positioned to withstand external shocks?

- ESG awareness: Are governance structures in place to guide ethical and effective responses to policy changes?

No small cap is fully insulated from global policy shifts, but these indicators can help investors identify companies that are inherently better prepared.

How Ironwood Approaches This Challenge

At Ironwood Investment Management, LLC, evaluating small caps through the lens of trade policy resilience is embedded in its fundamental, bottom-up research philosophy. Ironwood’s Small Cap Core Strategy emphasizes:

- Stock selection over sector bias: Portfolio construction is guided by conviction in company fundamentals, not sector trends

- Focus on High I-Q companies: Firms with adaptable leadership and strong balance sheets are prioritized

- Diversification with discipline: The portfolio typically holds 60–80 positions across industries, providing flexibility without overconcentration

This research-intensive, patient approach is built to uncover companies with the potential to navigate complex macro environments and create long-term value.

Why Work with Ironwood?

In today’s unpredictable trade environment, aligning with a firm that understands both macro-level shifts and micro-level business quality can make all the difference.

Ironwood Investment Management, LLC has developed a disciplined methodology for identifying small-cap companies that exhibit:

- Strong domestic operational capabilities

- Visionary, adaptable leadership

- Fundamental strength grounded in resilient business models

With a team of seasoned professionals and a strategy honed over decades, Ironwood offers insights into how companies can adapt and position themselves for potential growth amid changing policy regimes.

Let’s Start the Conversation

If you’re an investor navigating a shifting policy landscape, Ironwood invites you to explore how its research-driven approach may align with your investment goals. Reach out for a consultation or subscribe to our latest insights.

Important Disclosures & Disclaimers

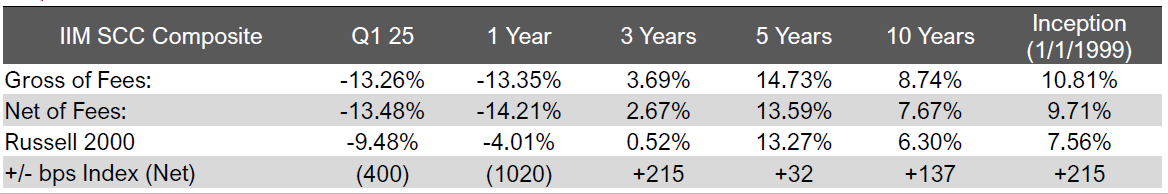

Performance Statistics – as of Q1 2025

Ironwood Investment Management®, LLC (Ironwood) is an independently managed investment advisory firm providing investment advisory services to institutional clients, mutual funds, and high-net-worth clients.

The firm is a registered investment adviser with the Securities and Exchange Commission. SEC Registration does not imply a certain level of skill or training.

Accounts in the Small Cap Core composite include separately managed, fully discretionary, fee-paying portfolios. Portfolios are invested in undervalued securities, the majority of which will have market capitalizations under $2.5 billion at cost, including securities with growth and/or value characteristics. Securities are considered undervalued when management believes the current share price does not accurately reflect the long-term economic value of the underlying company.

Ironwood Investment Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ironwood Investment Management, LLC has been independently verified for the periods January 1, 1999, through December 31, 2021. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

The Small Cap Core composite has had a performance examination for the periods July 1, 2002, to December 31, 2021. The verification and performance examination reports are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The creation date of the composite: July 2002. Performance inception date of the composite: January 1, 1999. Prior to July 2002, portfolios were included in the composite when at least 75% of the portfolio was invested in equity securities and when at least 75% of the portfolio was invested according to the investment style of the composite. Subsequent to July 2002, portfolios are included in the composite after the first full month of being fully invested.

Returns are presented gross and net of management fees and include the reinvestment of all income. Net returns are calculated based on the highest fee of 1.00%. Investment management fees are 1.00% on the first $25 million, 0.90% on the next $25 million, 0.80% on the next $50 million, and 0.75% over $100 million on an annual basis, and a client’s return will be reduced by these and other related expenses. The actual fee charged to an individual portfolio may vary by size and type of portfolio and may be negotiated. Actual investment advisory fees incurred by clients may vary.

The Russell 2000 Index consists of the 2000 smallest stocks in the Russell 3000 Index, representing approximately 8% of the U.S. equity market capitalization. The indices have been reconstituted annually since 1989. Ironwood returns and Index performance reflect reinvested interest income and dividends in U.S. dollars.

A list of composite descriptions and a list of limited distribution pooled fund descriptions are available upon request. Past performance is not indicative of future results. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. Prior to May 2006, the Firm was known as Ironwood Capital Management, LLC.

Past Performance is Not Indicative of Future Results

The performance data provided in this blog reflects past performance, which may not be representative of future results. Investing in small cap stocks and other securities involves substantial risk, including the potential loss of principal. There is no guarantee that any investment strategy will be successful.

Forward-Looking Statements

This blog contains forward-looking statements, including expectations or forecasts about the performance of the market and specific securities. These statements are based on Ironwood Investment Management, LLC’s current beliefs and expectations but are subject to change without notice. Actual results may differ materially from those expressed or implied due to various risks and uncertainties, including market conditions, economic factors, and changes in government policy.

No Offer or Solicitation

This blog is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities or investments. It is not intended to provide investment advice or to serve as a recommendation regarding any investment strategy. No client-adviser relationship is formed by reading this blog.

Conflicts of Interest

Ironwood Investment Management, LLC may hold positions in or recommend securities discussed in this blog. Clients should carefully review any investment strategy before committing to ensure it aligns with their investment objectives and risk tolerance.

Regulatory Disclosure

Ironwood Investment Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.